sales tax on clothing in buffalo ny

PO Box 13480 BUFFALONew York 14218. Wayfair Inc affect New York.

1990 Buffalo Traditional High School Yearbook The Premier Buffalo Ny Ebay

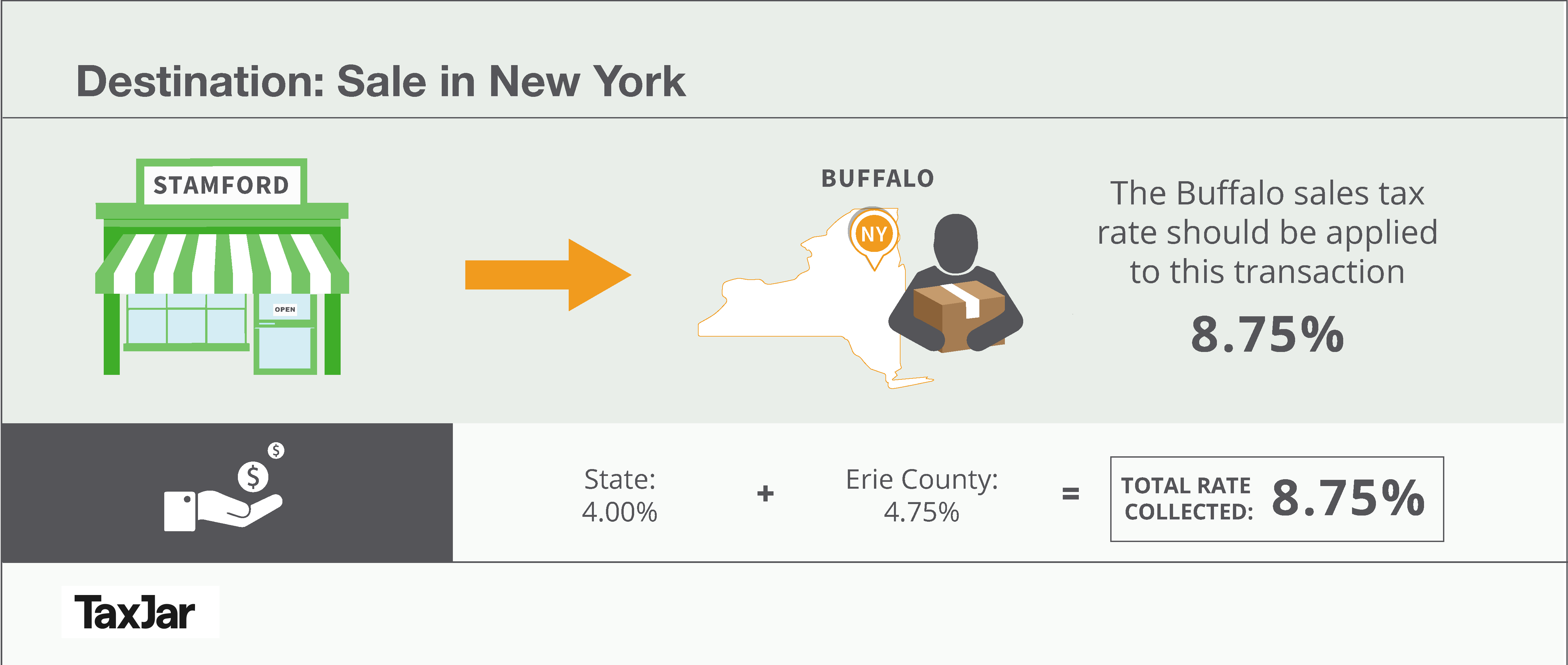

This includes the rates on the state county city and special levels.

. The 2018 United States Supreme. Buffalo NY Sales Tax Rate The current total local sales tax rate in Buffalo NY is 8750. Buffalo is located within Erie County New York.

Thats the amount that triggers an extra 4 percent state sales tax charge on clothing and footwear purchases in New York. March 10 2014 Clothing footwear and items used to make or repair exempt clothing sold for less than 110 per item or pair are exempt from the New York State. By Mark ScottBuffalo NY There will be no sales tax free week on clothing purchases for back-to-school shoppers this year.

Shoppers in New York State are getting back their clothing tax exemption on up to 110 per item. At any rate in 1045 area you have to. 0125 lower than the maximum sales tax in NY The 875 sales tax rate in Buffalo consists of 4 New York state sales tax and 475 Erie County sales tax.

Buffalo New York Level Contributor 107 posts 34 reviews 24 helpful votes 1. While dropping the county sales tax on clothing and footwear would save shoppers money it would cost the Village of Williamsville nearly 21000 in lost tax revenues. 888 837-1407.

A change in the law this year Search Query. Sales Tax 6 years ago 875 If youre clothing total is under 110 I believe the 4 NYS tax is waived. New York NY Sales Tax Rates by City The state sales tax rate in New York is 4000.

Beginning Sunday clothing and footwear priced under 110 will be exempt from. 888 837-1407. Clothing and Clothing Accessories Store in Buffalo Erie County.

The minimum combined 2022 sales tax rate for Buffalo New York is. The New York sales tax rate is currently. The December 2020 total local sales tax rate was also 8750.

There is no applicable city tax or. The Buffalo sales tax rate is. While all forms of athletic apparel and protective gear and most accessories are taxable standard clothing and shoes are tax-exempt up to 175 per item.

Buy a coat for 10999 and youll avoid that. By Mark Scott Buffalo NY A sales tax-free week on clothing purchases in New York began Monday. The County sales tax rate is.

With local taxes the total sales tax rate is between 4000 and 8875. Is an Ein The Same as a Sales Tax ID. Did South Dakota v.

The average cumulative sales tax rate in Buffalo New York is 875. Items that cost more. The City Sales Tax rate is 45 NY State Sales and Use Tax is 4 and the Metropolitan Commuter Transportation District surcharge of 0375 for a total Sales and Use.

Seller Permit Buffalo PepSole Proprietorship Clothing in Buffalo Erie County NY.

New York Resale Certificates For Businesses Legalzoom

Saratoga County Passes Gas Sales Tax Cap

Taxes Visit The Usa L Official Usa Travel Guide To American Holidays

The New York Clothing Sales Tax Exemption Demystified Taxjar

Thrift Shop Hearts For The Homeless

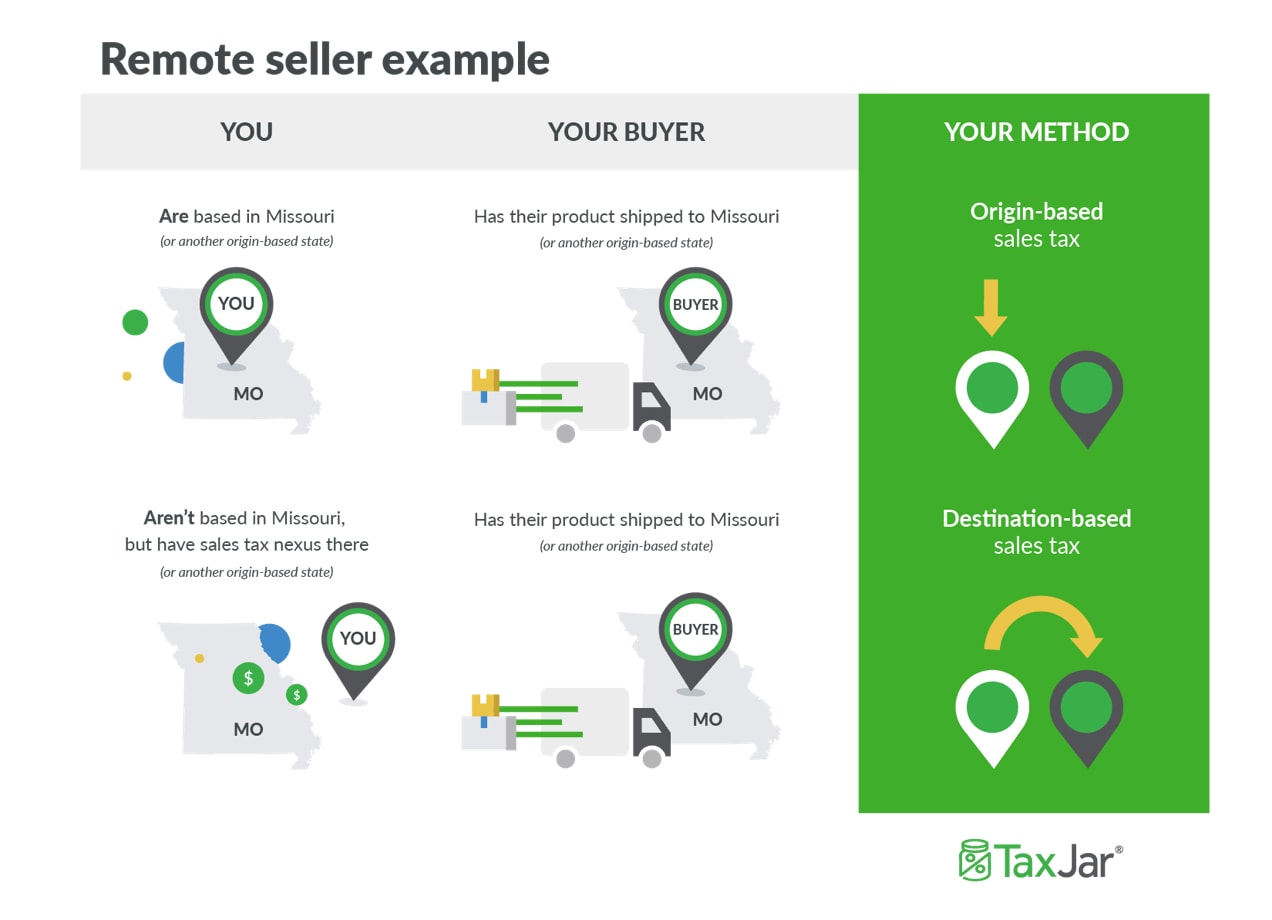

How To Charge Your Customers The Correct Sales Tax Rates

Tax Free 12 States Are Cutting Back To School Sales Tax This Weekend Marca

Thrift Shop Hearts For The Homeless

2 Hazelwood Ave Buffalo Ny 14215 Realtor Com

State And Local Sales Tax Rates Sales Taxes Tax Foundation

The Seller S Guide To Ecommerce Sales Tax Taxjar Developers

New York City Sales Tax Rate And Calculator 2021 Wise

Another Potential Station Twelve Tenant Goes To The Boulevard

The New York Clothing Sales Tax Exemption Demystified Taxjar

Dutchess County Enacts Sales Tax Exemption

Thrift Shop Hearts For The Homeless