december child tax credit amount

Disbursement of advance Child Tax Credit payments began in July and continued on a monthly basis through December 2021 generally based on the information contained in. Browse Our Collection and Pick the Best Offers.

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet

The way the child tax credit payments will be divided between 2021 and 2022 might be confusing.

. From July to December of 2021 eligible families received an advance child tax credit up to 300 per child under six years old and 250 for children between the ages of six to. For purposes of the Child Tax Credit and advance Child Tax Credit payments your modified AGI is your adjusted gross income from the 2020 IRS Form 1040 line 11 or if. Since the child tax.

The child tax credits are worth 3600 per child under six in 2021 3000 per child between six and 17 and. Ad Free means free and IRS e-file is included. The advance Child Tax Credit payments disbursed by the IRS from July through December of 2021 were early payments from the IRS of 50 percent of the amount of the Child.

The American Rescue Plan increased the child tax credit amount from 2000 per child in 2020. Max refund is guaranteed and 100 accurate. Eligible families who did not.

Currently lawmakers plan to phase out the increase payments but the bill hasnt passed just yet. Have been a US. The next child tax credit check goes out Monday November 15.

For each qualifying child age 5 and younger up to 1800 half the total will come in six 300. In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of. Check Out the Latest Info.

This means that the total advance payment amount will be made in one December payment. December Child Tax Credit. IR-2021-153 July 15 2021.

Families could be eligible to get 205 for each. Ad December child tax credit. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics.

The 2021 advance was 50 of your child tax credit with the rest on the next years return. The American Rescue Plan increased the amount of the Child Tax Credit from 2000 to 3600 for qualifying children under age 6 and 3000 for. Also the final.

This would be 1800 for a child under 6 years old and 1500 for a child between 6 and 17. Claim the full Child Tax Credit on the 2021 tax return. Below we lay out a few different scenarios and explain how much your family could be getting with the payments set to go out on December 15.

However the deadline to apply for the child tax credit payment passed on November 15. However the deadline to apply for the child tax credit payment passed on November. If you and your family meet the income eligibility requirements and you received each payment between July and December last year you can expect to receive up to 1800 for each child.

You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors. This would be 1800 for a child under 6 years old and 1500 for a child between 6 and 17. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim.

The maximum child tax credit amount will decrease in 2022. See what makes us different. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families have started receiving monthly Child Tax Credit payments as direct deposits begin posting in bank accounts and checks arrive in mailboxes.

Taxpayers can get up to 3000 for the 2022 tax year if theyve got an unborn child with a detectable heartbeat between July 20 and Dec. The credit amount was increased for 2021. We dont make judgments or prescribe specific policies.

The child tax credit for 2021 came in response to unique circumstances. It also raised the age limit to 17-year-olds and sent part of the credit as direct. The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per qualifying child.

This first batch of advance monthly payments worth.

Know The Key Dates For Health Care Reform Open Enrollment Best Health Insurance Health Insurance

Child Tax Credit 2022 How Much Money Could You Get From Your State Cnet

Child Tax Credit 2022 Could You Receive A Double Monthly Payment In February Marca

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

Parents Guide To The Child Tax Credit Nextadvisor With Time

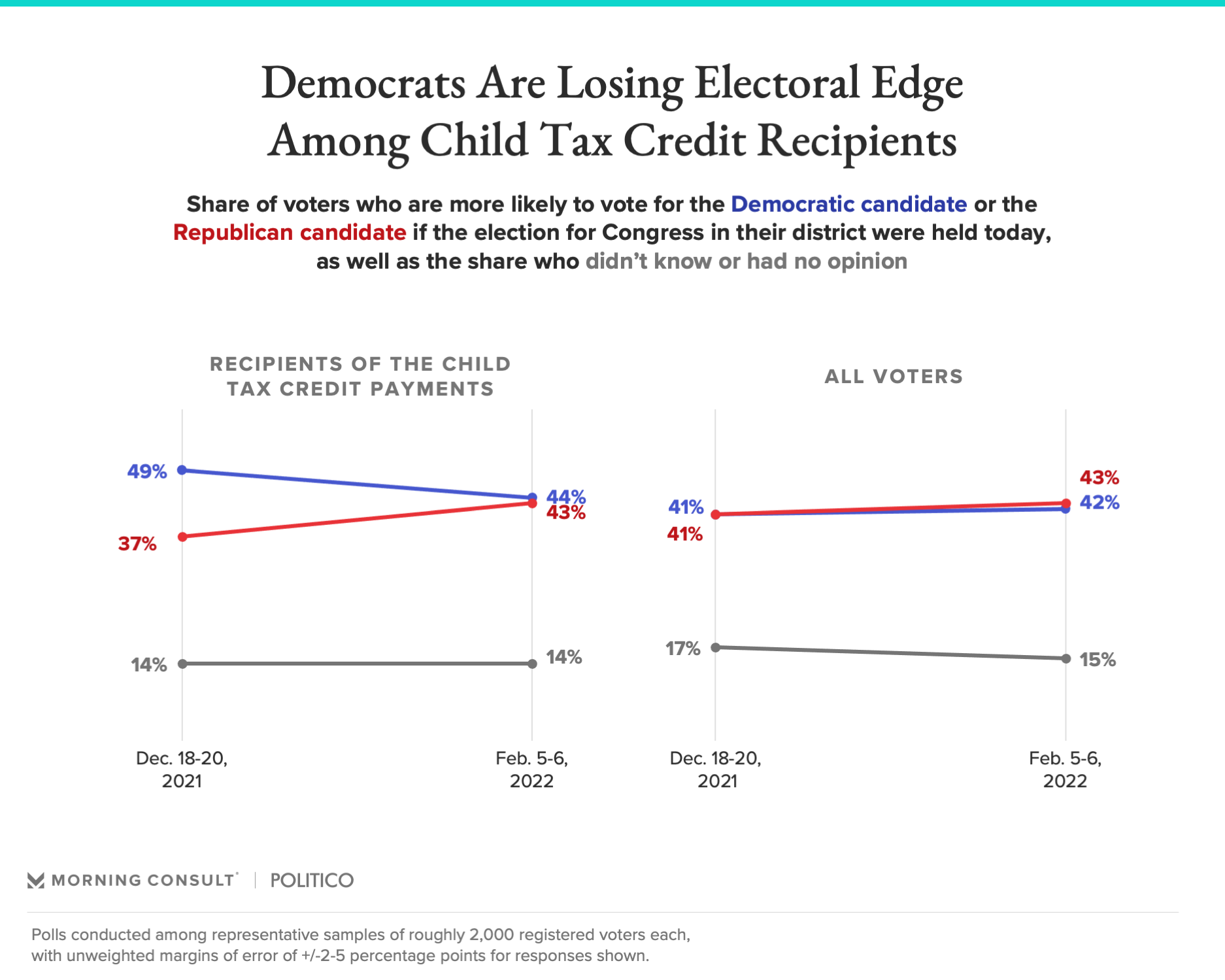

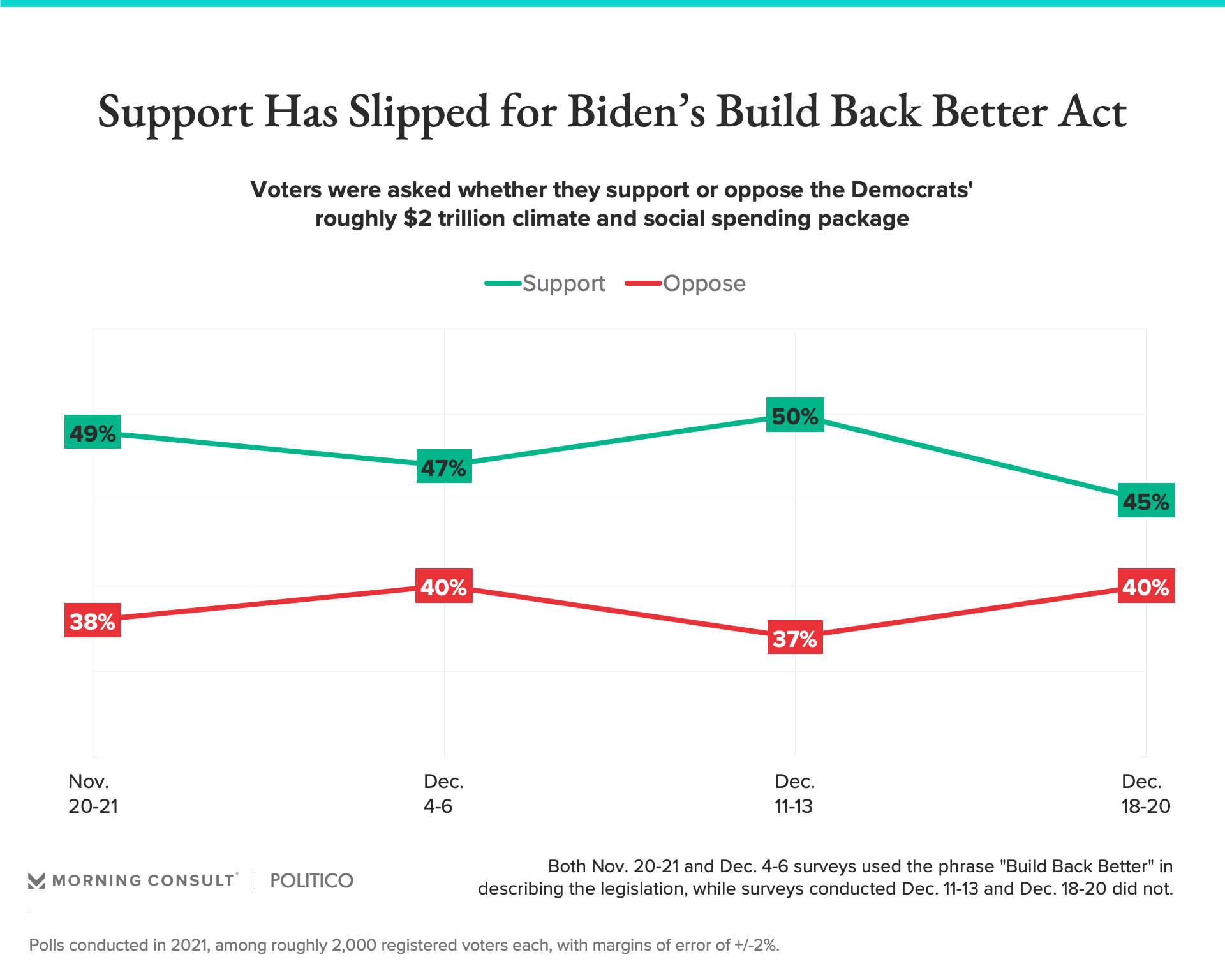

Voters Are Divided Over One Year Extension Of Expanded Child Tax Credit

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

Irs Sends Millions Letters About The Monthly Child Tax Credit Payments Forbes Advisor

Which Filing Status Is Right For You For All The Visual Learners Out There This Board Is For You We Ve Cond Finance Infographic Filing Taxes Online Taxes

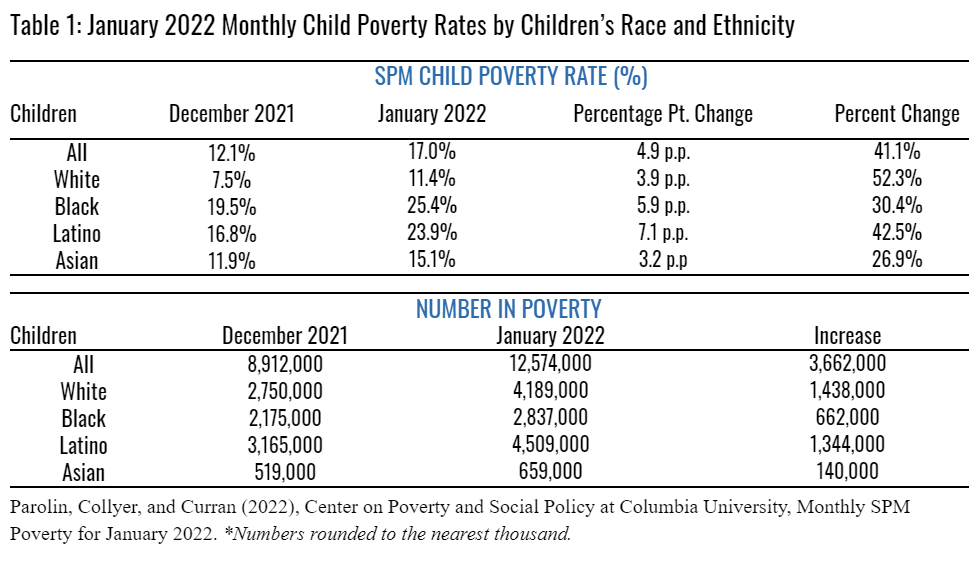

Absence Of Monthly Child Tax Credit Leads To 3 7 Million More Children In Poverty In January 2022 Columbia University Center On Poverty And Social Policy

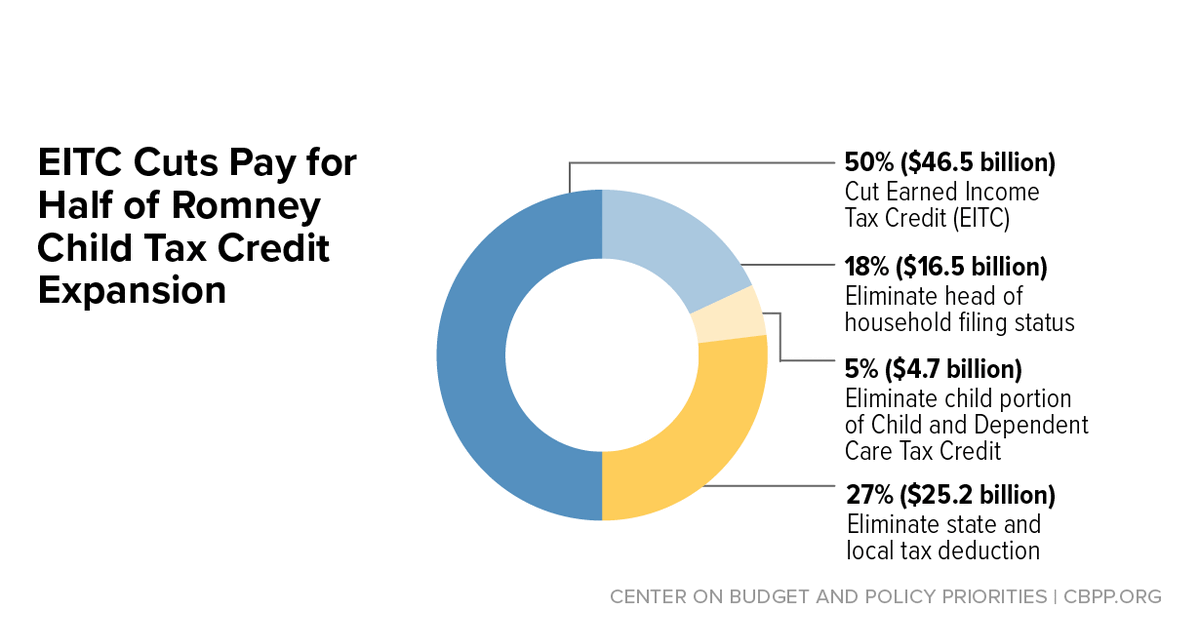

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

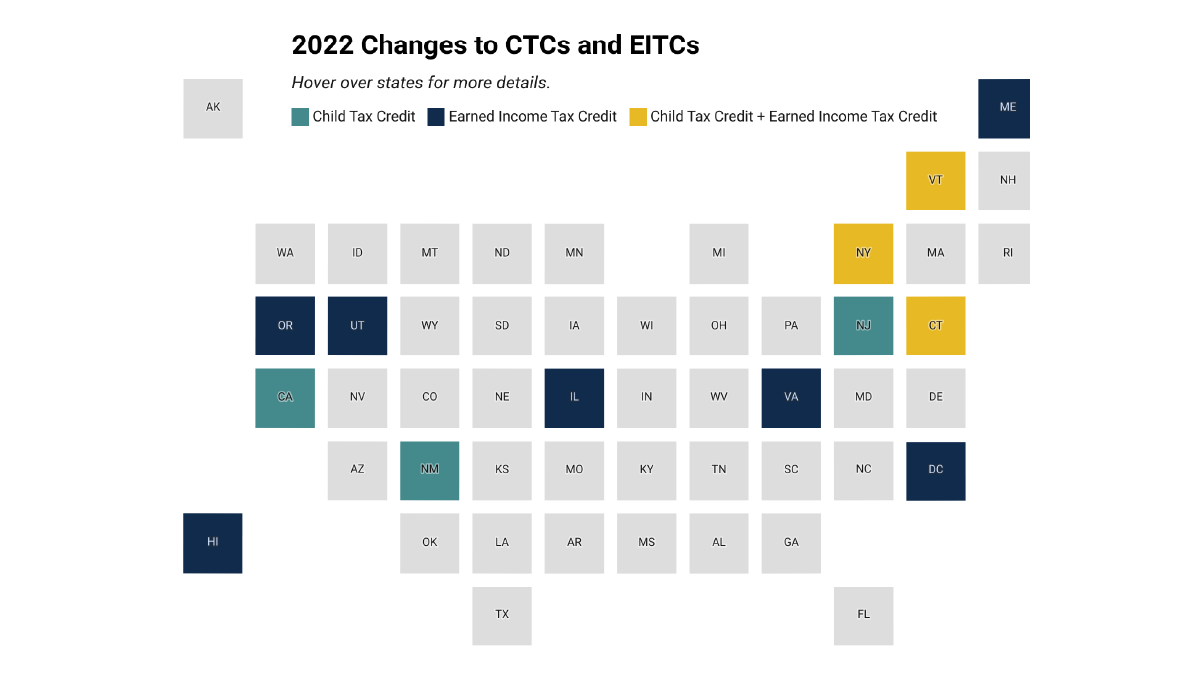

Legislative Momentum In 2022 New And Expanded Child Tax Credits And Eitcs Itep

The Expanded Child Tax Credit Briefly Slashed Child Poverty Npr

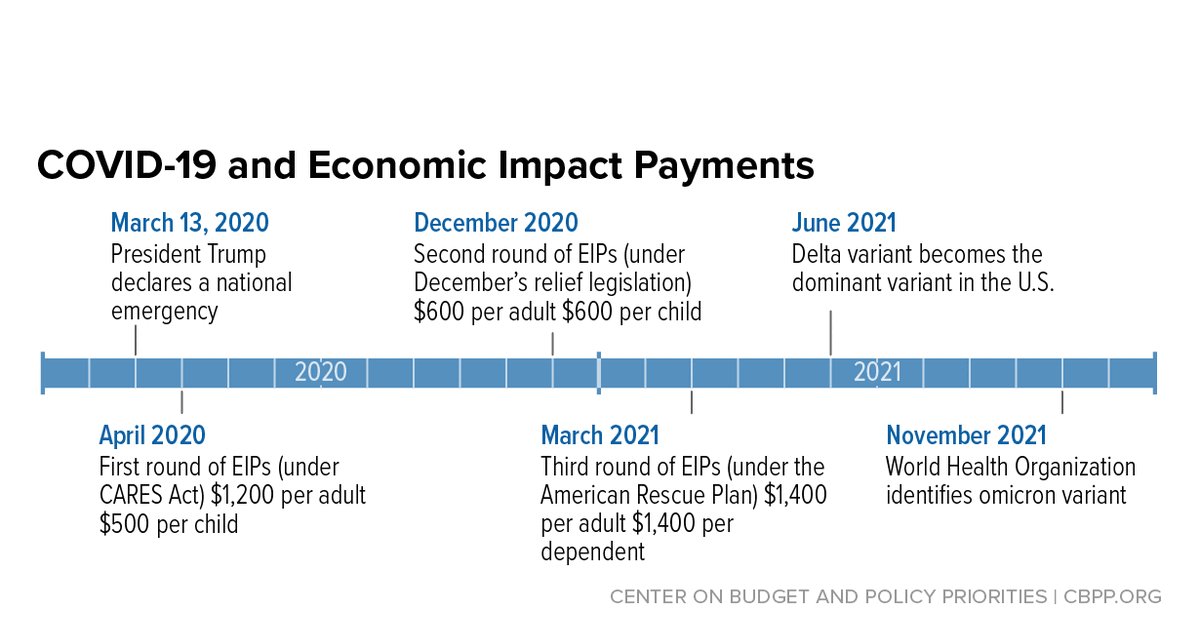

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

3 Form Usa 3 Important Life Lessons 3 Form Usa Taught Us

Child Tax Credit Ending Will Push 10 Million Kids Back Into Poverty